- Asian markets struggle for direction

- Dollar waits for Federal Reserve rate decision

- Gold grinds higher on market caution

Asian markets were subdued on Wednesday morning as investors grew increasingly anxious over the lack of update on US-China trade talks.

Repeated mixed signals and messages ahead of the December 15 tariff deadline is fostering confusion across financial markets. This sentiment continues to be reflected in global equities as markets adopt a ‘wait and see’ approach until clarity and direction are offered on the trade front. In Europe, shares are expected to make a cautious start ahead of the U.S Federal Reserve’s final interest rate decision of 2019. Given how uncertainty remains a dominant theme this week, safe-haven assets like Gold and the Japanese Yen have the potential to appreciate as investors head for safety.

Steady Dollar ahead of Fed meeting

The Federal Reserve is widely expected to leave interest rates unchanged at 1.75% in December.

However, much of the focus will be directed towards the policy statement, economic projections, dot plot and press conference for clues on future monetary policy. Speculation around the Federal Reserve cutting interest rates anytime soon have been quelled by November’s blockbuster US jobs report. Although markets are pricing in a 54% probability of a rate cut by September 2020, it will be interesting to see whether the dot plot mirrors market expectations. Appetite towards the Dollar will also be influenced by Fed Chairman Jerome Powell’s remarks on the US economy and monetary policy. Should the press conference and policy statement adopt a dovish tone, the Dollar Index may dip back towards 97.40.

Pound dips on UK poll projections

Sterling’s depreciation against the Dollar on Wednesday continues to highlight how the currency remains extremely sensitive to polls.

Appetite towards the Pound was dealt a blow heavy after a poll showed a narrowing lead for Prime Minister Boris Johnson’s Conservative Party. Given how the general election is around the corner, the British Pound is set to remain volatile and highly reactive to polls.

Focusing on the technical picture, the GBPUSD is struggling to defend 1.3100 on the daily charts. A solid breakdown below this point should encourage a decline towards 1.3000 in the short to medium term.

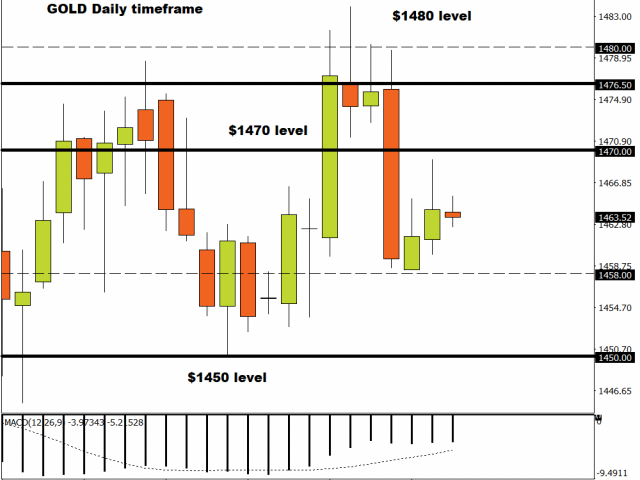

Commodity spotlight – Gold

Gold is grinding higher amid caution ahead of a looming tariff deadline on December 15th. The precious has gained roughly 0.25% since the start of the week thanks to investors adopting a guarded approach. The sense of uncertainty is likely to continue supporting appetite for safe-haven assets for the rest of this week.

Gold is seen swinging within a range in the near term ahead of the tariff deadline. Prices are seen testing $1470 amid the market caution, with further uncertainty injecting bulls with enough confidence to attack $1476.50 and $1480, respectively. Given how the precious metal remains highly sensitive to trade headlines, any good this week could result in a decline back below $1458.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.