- Risk aversion returns on possible delay in trade deal

- Dollar hit by disappointing economic data

- Pound to remain choppy ahead of general elections

- Gold rises from the ashes and eyes $1492

It is another day, but the same old story with trade developments as conflicting signals on the progress of negotiations foster confusion and uncertainty.

In the latest twists and turns of the trade saga, President Donald Trump has said a trade deal with China could be delayed until after the 2020 U.S presidential elections, essentially dashing hopes of a phase one deal before mid-December. Given how a delay will most likely result in prolonged uncertainty and tensions between the world’s two largest economies, this certainly does not bode well for global equity markets. Stocks in Asia are flashing red on Wednesday morning thanks amid the negative sentiment and is poised to contaminate European markets.

With less than two weeks to go until the next tariff deadline on December 15th where 15% levies on an additional $160 billion worth of Chinese goods will go into effect, the clock is dangerously ticking. Risk aversion is set to engulf financial markets if Washington moves ahead with the tariff hikes, as trade tensions intensify and global growth concerns send investors rushing towards safe-haven assets like Gold.

King Dollar bruised by disappointing data

It has not been the best trading week for the Dollar Index which continues to nurse deep wounds inflicted by disappointing economic data.

Official reports released earlier in the week showing that the US manufacturing sector contracted for the fourth consecutive month in November sparked jitters over the health of the largest economy in the world. This led to a selloff that dragged the Dollar Index to levels not seen three weeks below 97.67.

Although the King Dollar has entered December on a negative note, the currency could be offered some support if the pending ADP Non-Farm Employment Change and ISM Non-Manufacturing PMI data exceed market expectations.

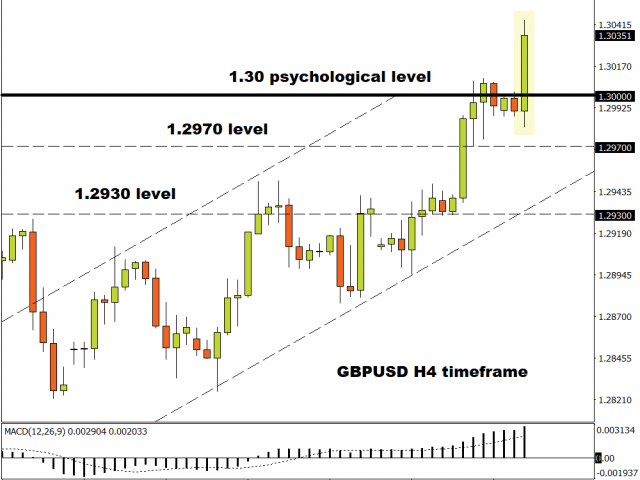

Pound punches above psychological 1.30 level

The British Pound has gained against almost every single 10 currency this week excluding the Swiss Franc.

With the general elections just over one week away, the currency will most likely remain volatile and heavily influenced by the polls. Although the GBPUSD blasted above the 1.30 on Wednesday, it will take a major catalyst or significant event for bulls to truly conquer this stubborn resistance level.

Investors will focus their attention towards the final services PMI report scheduled for release on Wednesday morning. While a print that meets or exceeds expectations may prop Sterling higher, the currency is more concerned with political developments in Westminster and Brexit.

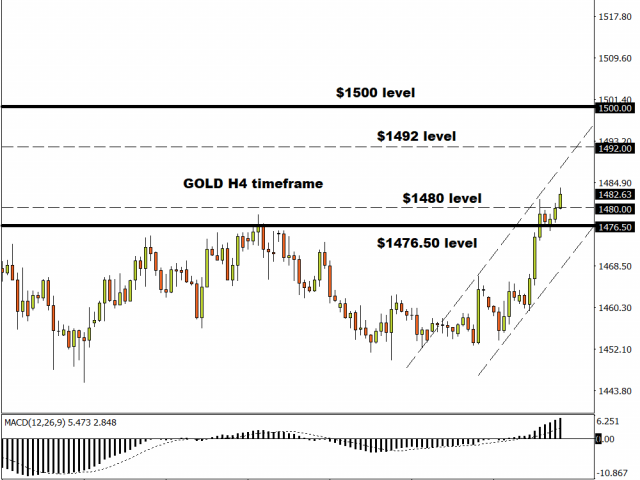

Commodity spotlight – Gold

Gold staged an incredibly rebound yesterday, punching above $1480 thanks to renewed uncertainty on the US-China trade front.

Appetite towards the precious metal is likely to receive a boost if Washington moves ahead with the tariff hikes on December 15th. Other major themes in the form of Brexit and global growth concerns are seen pushing the precious metal higher in December.

Focusing on the technical picture, Gold is bullish on the 4 hour timeframe with prices trading around $1480 as of writing. The upside momentum could send prices back towards the $1492 level in the short to medium term.

MyFxtops (www.myfxtops.com)-a reliable foreign exchange ordering community, follow the masters for free!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.