Fears over the potential impact of the coronavirus outbreak spreading in Europe weakened the Euro against the Dollar and most G10 currencies on Tuesday.

Italy now has the highest number of coronavirus cases outside Asia, reporting over 280 cases. Questions are being raised whether the European nation will be able to contain the outbreak with investors prices in an increased chance the European Central Bank will cut interest rates sooner rather than later.

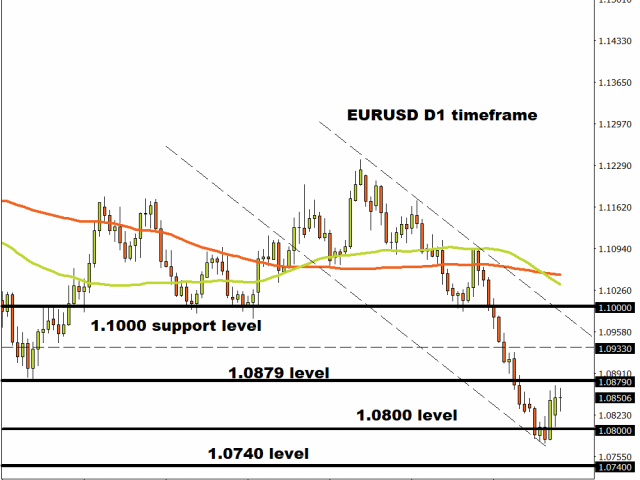

In regards to the technical picture, the EURUSD is under pressure on the daily charts as there have been consistently lower lows and lower highs. Sustained weakness below 1.0879 could encourage a decline back towards 1.0800 and 1.0740. Alternatively, a breakout above 1.8790 should open a path back towards 1.0933.

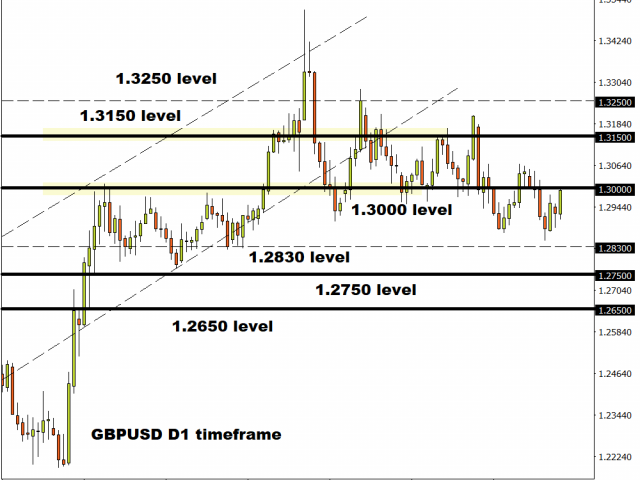

Can the GBPUSD break above 1.3000

Sterling has appreciated against every single G10 currency today despite new headlines on the Brexit front or data from the United Kingdom.

The currency is likely to appreciate further on price action ahead of the official post-Brexit trade talks next week. Looking at the technicals, the GBPUSD is trading marginally below 1.3000 as of writing. A solid daily close above this level could re-open doors back towards 1.3150. Should 1.3000 prove to be reliable resistance, prices are seen descending back towards 1.2830.

Oil outlook hinges on OPEC meeting

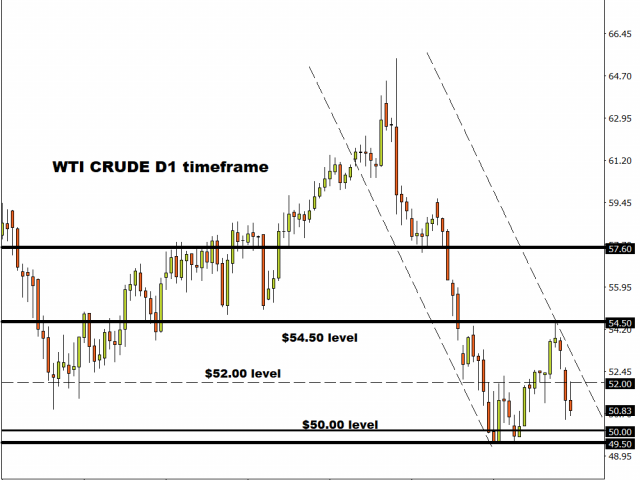

Where Oil trades at the end of Q1 will be heavily influenced by the outcome of the OPEC meeting starting on March 5.

The past few weeks have been rough and rocky for Oil markets thanks to coronavirus fears and global growth concerns. China is the largest energy consumer, so a slowdown in China amid the virus outbreak could shake the supply/demand dynamics of Oil markets.

Looking at the charts, WTI Crude remains bearish on the daily time frame. Demand side concerns should drag prices lower with $50 acting as the first level of interest.

Dollar Index slips towards 99.00

Earlier this morning, we highlighted how the Dollar could weaken on speculation around the Federal Reserve cutting interest rates sooner than later.

The Dollar Index has extended losses this afternoon following the disappointing Conference Board consumer confidence report for February. Prices could decline back towards 98.70 if a daily close below 99.00 is achieved. Alternatively, if 99.00 proves to be a solid support, prices could rebound back towards 99.30 and 99.50.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.