Questions are likely to persist on how long this rally could last for, but hopes that more economies are re-opening their doors is pushing risk appetite higher today.

The main casualty has been the US Dollar with its safe haven counterparts like the Yen and Gold also dipping, but it is the USD that has felt the brunt of the feel-good momentum.

GBPUSD is up by nearly 200 pips, making the hysteria that took place just yesterday over special advisor to UK Prime Minister, Dominic Cummings breaking the lockdown rules ordered by Boris Johnson feel like a lifetime ago. All of the issues for the Pound are unlikely to be completely done, but there is perhaps more room for a small adjustment higher following all of the negative views on Pound sentiment in recent days.

EURUSD is stronger by close to 100 pips, however it is approaching the area towards 1.10 that has restricted further upside on multiple occasions in the past.

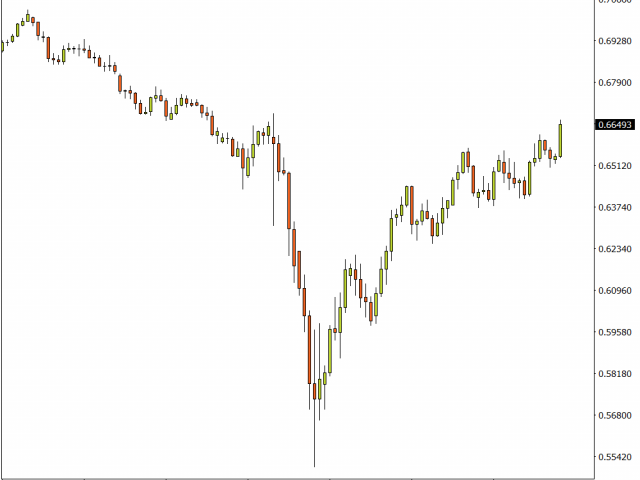

AUDUSD on the Daily is perhaps the most interesting chart. A 100 pip advance today might appear modest when compared to GBPUSD, but a combination of hopes that the Australian Government will announce fiscal stimulus to help its economy alongside USD weakness should ignite a spark for the Aussie.

(AUDUSD Daily FXTM MT4)

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.