Markets kicked off the new month in mixed fashion, as protests in major US cities over the weekend threaten the nascent post-pandemic recovery in the world’s largest economy. The outbreak of violence stateside adds another layer of uncertainty to global investors who are already contending with the risk of heightening US-China tensions. These downside risks are preventing riskier assets from going off on a rally, as investors curtail their optimism that the worst of the global pandemic is now behind us.

Asian stock and currency markets are a sea of green on Monday, while Dow futures erased earlier losses in a sign of resilient risk appetite. The gains in Asian equities were led by Hong Kong’s Hang Seng index, which climbed 2.5 percent at the open after US President Donald Trump stopped short of imposing fresh sanctions over China.

Gold keeps upward trend intact

However, there remains a prevailing sense of caution, with Gold sticking to its upward trend, having registered higher highs and higher lows on the hourly charts since May 27. However, Bullion’s advance is being resisted for the time being at the $1740 psychological line, as was the case on May 22. However, should the upward momentum continue, driven by risk aversion, then a meaningful breach above $1740 appears inevitable with a path towards $1765 then in its sights.

Oil traders await OPEC+ meeting

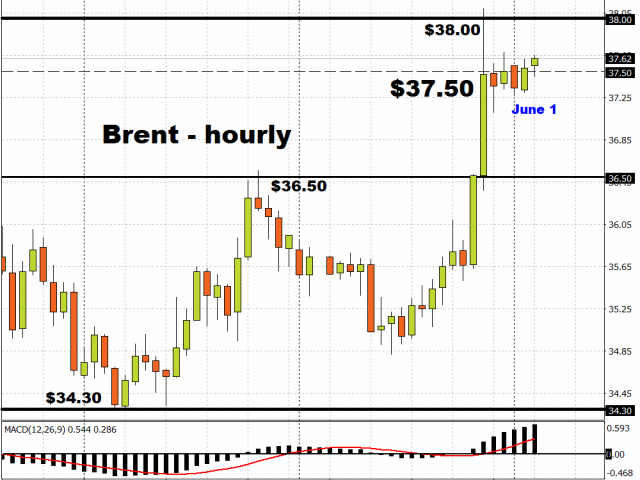

Another major commodity is also showing a tinge of restraint, with Brent Oil hovering around the mid-$37 range at the time of writing. Brent futures are holding on to most of their 33.66 percent gain in May, its first monthly advance so far this year, as investors assess the next direction for Oil prices.

Should the US protests persist and serve as a drag on economic activity, that could weigh on demand for the commodity. However, with more of the world reopening, coupled with reports that OPEC+ could move its meeting earlier to June 4 and extend their production cuts, such factors could translate into more lift for Oil prices.

Until there is some much-needed clarity, investor sentiment is expected to continue blowing hot and cold, which is lending to the current contrasts across the various asset classes.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.