Investors have marched into June with a renewed appetite for risk after President Donald Trump’s response to China’s new law reining in Hong Kong was not as bad as initially feared.

It looks like market players are dumping in favour of riskier currencies amid the growing optimism and this continues to be reflected across the G10 space. With the mighty Dollar entering the new trading month clearly on the wrong side of the bed, could weakness be a dominant theme over the next few weeks?

The Dollar Index (DXY) daily chart is certainly worth one thousand words. Prices are under pressure with bearish investors eyeing the 97.80 level. A solid daily close below this point may encourage a decline towards 96.25.

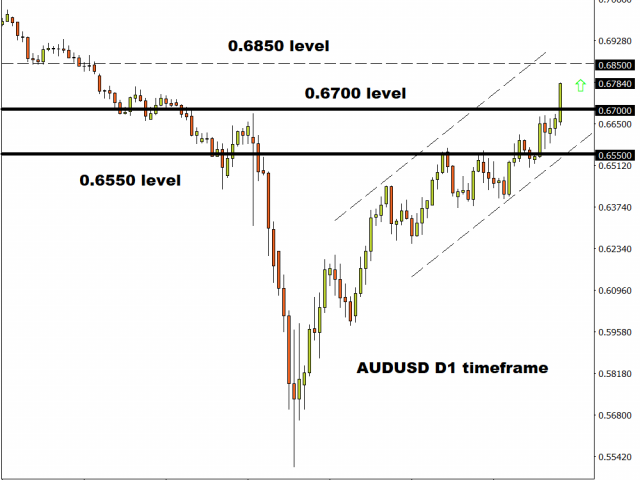

AUDUSD explodes higher with 0.6850 in sight

The Australian Dollar took advantage of a weaker Dollar on Monday as prices rallied towards 0.6800.

A weaker Greenback should inject Aussie bulls with enough inspiration to break above 0.6800 with 0.6850 acting as the next key level of interest. If rally runs out of steam and prices sink back under 0.6700, then the AUDUSD may retrace back towards 0.6550.

USDJPY remains rangebound

Prices are trading near the 108.00 resistance level and could sink back towards 107.00 if the Dollar continues to weaken. A breakdown below 107.00 may trigger a drop towards 105.90.

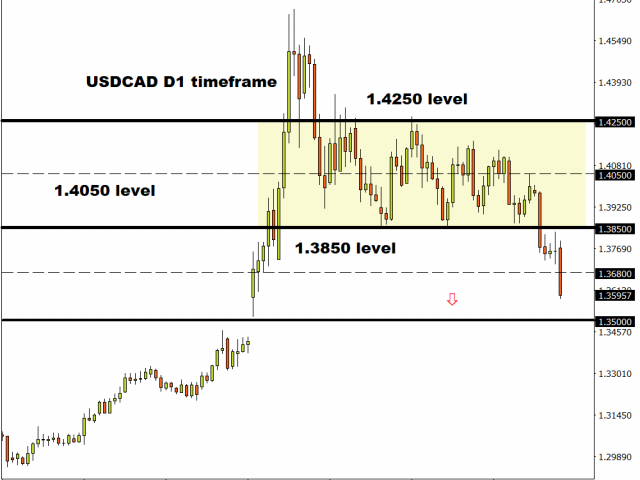

USDCAD tumbles below 1.3680

Talk about a way to start the final trading month of Q2.

The USDCAD has tumbled almost 200 pips today and could sink lower thanks to a severely depressed Dollar. Should the Canadian Dollar appreciate on rising Oil prices, the USDCAD may sink lower towards 1.3500.

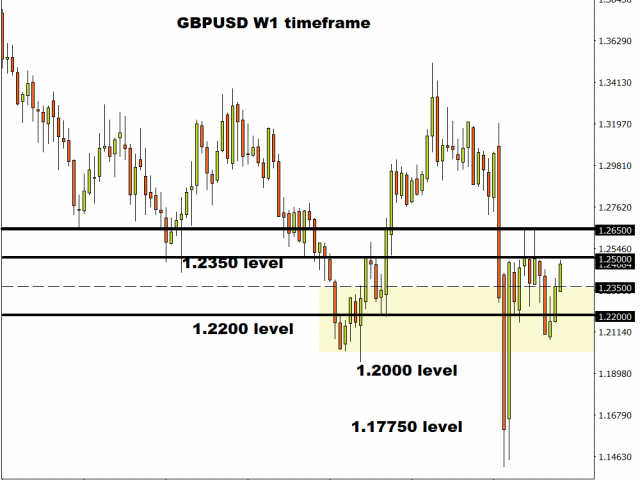

GBPUSD to break above 1.2500?

Who would have thought the GBPUSD would jump towards 1.2500 as Brexit talks official resume on Tuesday?

While the currency pair could push higher on Dollar weakness, the upside may be limited by uncertainty and fears over the UK economy.

A solid breakout above 1.2500 could trigger a move back towards 1.2650. Should 1.2500 prove to be a reliable resistance, prices may decline back towards 1.2350.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.