Financial markets extended gains on Tuesday as central bank stimulus and re-opening optimism fuelled appetite for risk.

Asian stocks have rallied for their ninth straight day following the overnight gains on Wall Street that propelled the Nasdaq 100 index to an all-time high. While global stocks may push higher in the short term, the medium to longer-term outlook remains clouded by a growing list of negative factors straining market sentiment.

Given how investors are questioning the apparent disconnect between stocks and gloomy fundamentals,

caution is clearly in the air and this continues to support safe-haven assets. When factoring sizzling trade tensions between the United States and China and fears around slowing global growth, storm clouds may be on the horizon.

This is being reflected in Japanese Yen which has appreciated against every single G10 currency today.

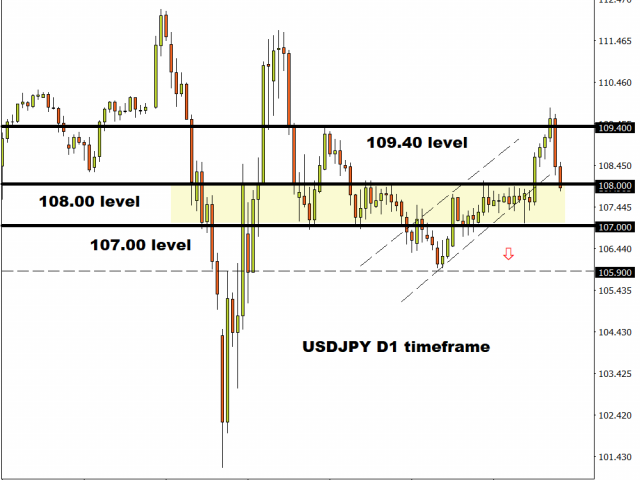

Looking at the charts, the Yen is steamrolling the Dollar with prices trading marginally below 108.00 as of writing. A solid daily close below this level may open the doors towards 107.00. This bearish setup may be validated once prices break below the 20 Simple Moving Average and the Moving Average Convergence Divergence (MACD) crosses to the downside.

Alternatively, if 108.00 proves to be a reliable support level, the USDJPY may rebound back towards 109.40.

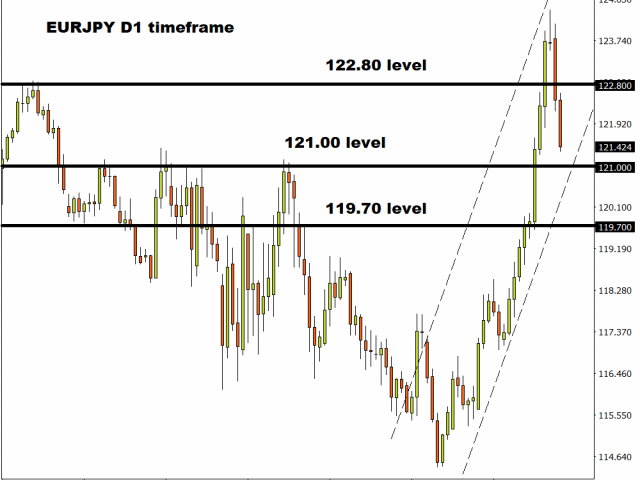

EURJPY tumbles towards 121.00

Over the past 36 hours, the EURJPY has tumbled over 250 pips with prices trading around 121.40 as of writing.

Prices remain in a bullish trend on the daily charts as there have been consistently higher highs and higher lows. A breakdown and daily close below 121.00 may threaten the uptrend and offer bears an opportunity to jump into the scene.

Should 121.00 truly give way, the next key point of interest will be found around 119.70. Alternatively, a rebound from 121.00 is seen triggering a rebound back towards 122.80.

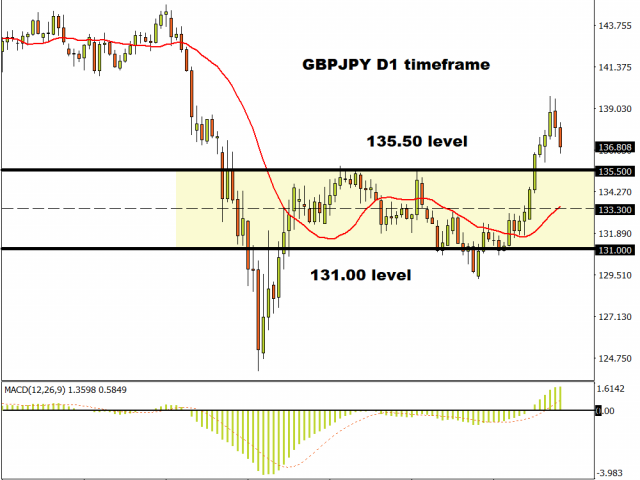

Time for GBPJPY to enter range?

An appreciating Yen is dragging the GBPJPY back towards the 135.50 dynamic support level.

If the currency pair breaks below this point, prices are likely to remain a wide range with support at 131.00 and resistance at 135.50. Given how the Pound is expected to remain unloved thanks to the Brexit drama and Yen seen appreciating on market caution, the GBPJPY may sink lower in the short to medium term.

Sustained weakness under 135.50 could open the doors back towards 133.30. Should the 135.50 dynamic level prove to be stubborn support, the GBPJPY may rebound towards 137.00.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.