Gold prices are edging about 0.1 percent higher today, as global investors monitor the latest developments surrounding the coronavirus pandemic. There’s a climb in Covid-19 cases in 20 US states, while the number of cases in Tokyo also reported a rise over the weekend, highlighting the fact that the coronavirus is not easily vanquished.

Should markets get the sense that another round of lockdowns in major economies is drawing nigh, that may derail the optimism surrounding a rapid economic recovery and spur further gains in safe havens.

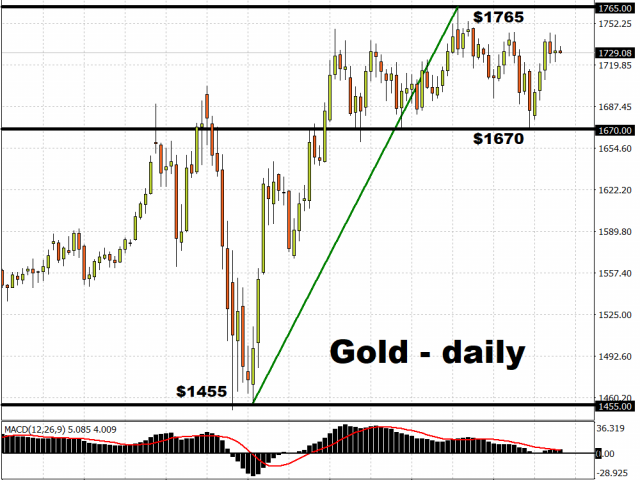

Note that on both the daily chart as well as the weekly timeframe, Bullion’s upwards trend seems to have plateaued around the mid-$1700 range. Gold bulls clearly benefitted for the two months since March when much of the global economy was placed on a lockdown, which in turn triggered a deep worldwide recession. However, since May, Gold has been unable to continue posting higher highs and higher lows, as the optimism surrounding the reopening of many major economies has kept Gold to a sideways pattern.

Still, the lingering fears in the markets appears to be keeping the $1670 support level mostly intact, perhaps providing the platform for Gold’s next big push higher.

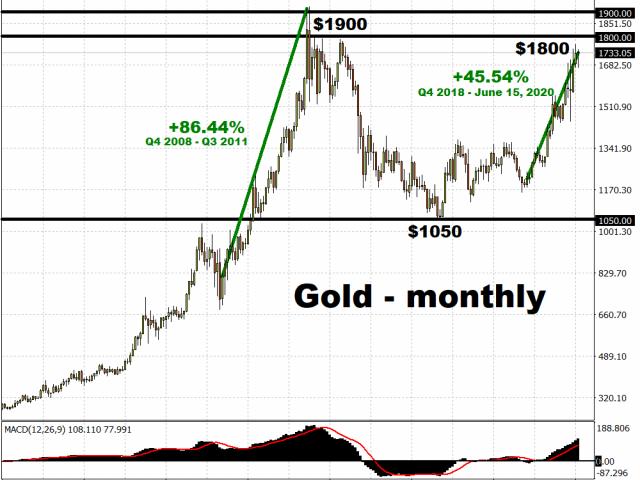

The precious metal is just about two weeks away from registering its 7th consecutive quarterly gain, a run that stretches back to Q4 2018. This is the longest such streak since the 2008-2011 Gold bull run, with prices climbing for 12 consecutive quarters. That stretch also included the record high of $1920.60, a record that still stands till this day.

It’s amidst such tense market environments that Gold tends to shine. Bullion has already seen tailwinds from US interest rates falling to near-zero, coupled with the overall risk aversion from the global pandemic. However, the US Dollar’s resilience has hampered Gold’s ability to surge even higher.

Should signs of a second wave of Covid-19 cases worldwide become more prominent, that could be the catalyst for Gold prices reaching the psychologically-important $1800 level for the first time since 2012.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.