Rebound optimism is in the summer air as PMI releases across the globe are pointing to a continuation of the economic recovery this month. Data in Japan, Australia and the Eurozone are pushing stock markets higher once more with the S&P500 endeavouring to break out of its recent range.

The Eurozone saw solid PMI beats with large gains in the services sector helping to beat economists’ forecasts and France now moving into expansionary territory. UK PMI numbers also exceeded expectations with manufacturing climbing into expansionary territory and the key services sector recording a smaller contraction this month.

With PM Johnson announcing more easing of the lockdown, Chancellor Sunak is toying with cutting the UK’s value added tax to help retailers and consumers. Public finances will take a hit though, which is a worry with government spending rising so quickly.

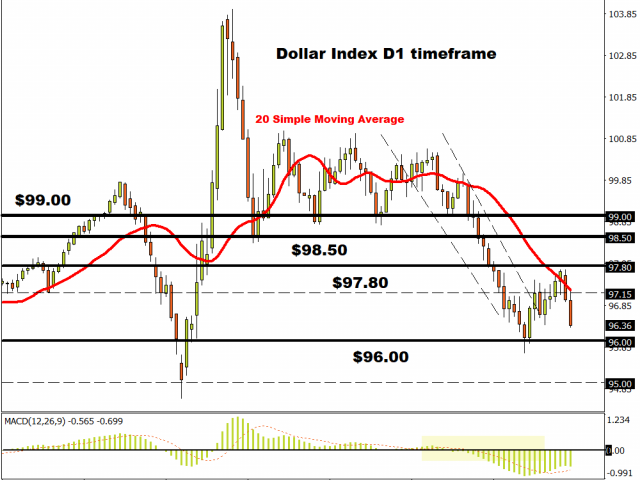

As the mood improves across markets, the Dollar Index descends back towards the 96.00 level. A breakdown below this point may open a clean path towards 95.00.

A struggle today for GBP

Cable is just about eking out some gains today despite the better data and positive risk environment. The 100d MA is proving hard to beat around 1.2490.

A move above this resistance, which also leads to a breakout above 1.2515 may see another leg higher back towards 1.2650-1.2750. Strong support lies around the 1.2340 zone.

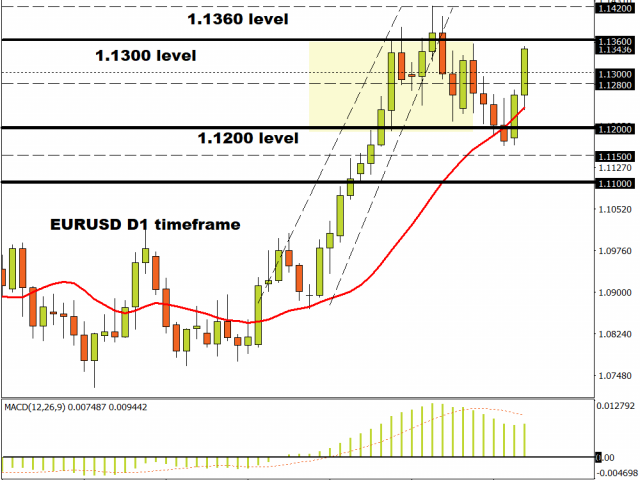

EUR movin’ on up

The single currency is trying to make a sustained push beyond 1.13 this afternoon, after bursting higher with the positive data earlier in the day.

The PMIs have provided a sharp sense of relief that a decent rebound is possible, but it’s probably early days to say the green shoots are fully grown yet. Prices are still within the 1.12-1.14 range with next resistance at 1.1335.

Commodity Spotlight: Gold

Gold bugs are liking the current ultralow rate environment at present, with negative real yields boosting demand for the precious metal, while the Covid shock to Emerging Market consumer demand recovers.

In the last few minutes, gold hit its best level since October 2012 at $1768 with dollar selling fuelling today’s rally. The long awaited breakout from the mid $1700s could be on the cards, with the next upside target coming in at $1796.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.