Asian stocks and US futures are climbing, even as the number of coronavirus cases worldwide nears 11.4 million. Over the weekend, the WHO reported a record one-day high in global infections, with 212,326 cases in a 24-hour period.

The Hang Seng index has broken above its 200-day moving average, notching a new 4-month high.

This morning, Japanese stocks roared past the 22,420 resistance level that has been in play since a week ago, confirming an uptrend on the hourly chart. Having posted higher lows so far this month with momentum now swinging into positive territory as well, the Jap225 candles could carve a path towards the 22,800 region, which is the upper bound of its sideway range since mid-June.

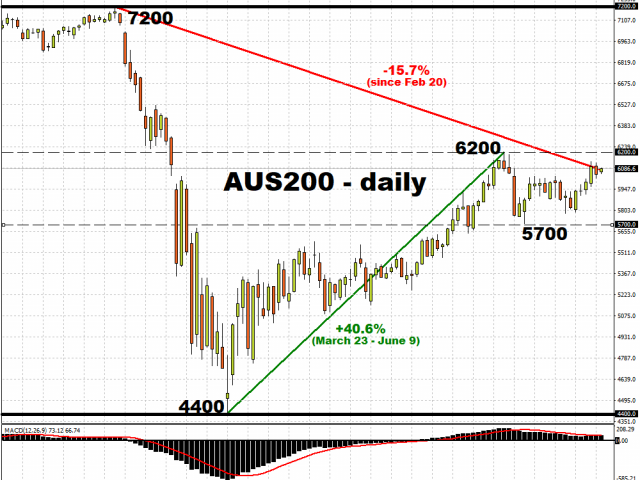

The S&P/ASX 200 is showing more muted gains compared to is regional peers. Australian stocks are still confined to that 6200 – 5700 range observed since the beginning of June, and still hanging on to much of the 40 percent advance since March.

Overall, global risk sentiment is set to mark time as it has been doing over recent weeks, unless jolted by a major catalyst. Investors are still searching for greater clarity, as concerns over a surge of coronavirus cases in major economies are dulling the green shoots of the global recovery.

Over the weekend, Bank of France Governor Francois Villeroy de Galhau said that the French economy is performing “better” than forecasted at the start of June. The June US non-farm payrolls data, released last Thursday, demonstrated the resilience of the jobs market in the world’s largest economy, aided by the government’s support measures.

However, the still-rising number of global cases implies that the threat of more disruptions to economic activity, potentially by way of reimposed lockdowns, remains a factor that warrants plenty of caution. Global investors will be poring over the economic data due to be released over the coming days, including Europe’s industrial production data, to assess whether risk assets are justified in climbing higher. If the market bears gather enough critical mass, they could determine that risk assets are ripe for retracement, and potentially unwind the gains seen in Q2.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.