It’s been a super busy Thursday with the ECB meeting and a bevy of US data to digest this afternoon. The former left all rates unchanged and kept its pandemic bond-buying program (PEPP) at €1.35tln as expected. President Lagarde made it clear the bank intends to make full use of the PEPP and is flexible regarding asset classes and countries, but bond buying will run at least through the end of June 2021. The ECB acknowledged the rebound in the region’s economy but there was still much uncertainty.

US retail sales surged up 7.5%, the second largest ever monthly gain after the May print and increasing more than expected for a second straight month. The consumer is certainly spending, even as the weekly jobless claims still linger above the one million mark, this week coming in at 1.3 million and above the estimates of 1.25 million.

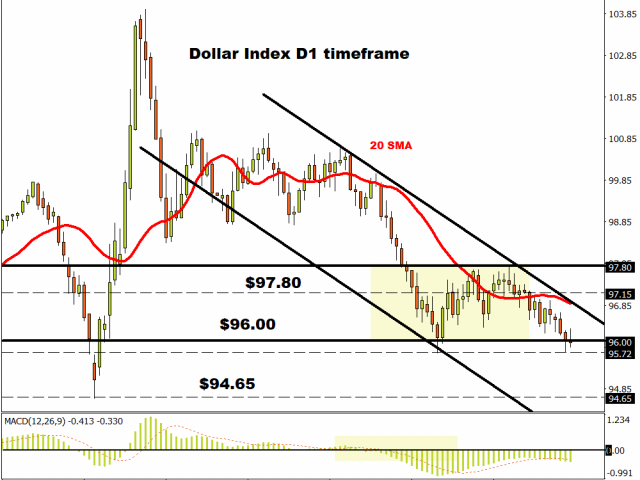

Global risk soured overnight with the sell-off in Chinese stocks and this cautious mood has continued with a weaker US open. That said, the dollar is moving lower amid challenging structural and cyclical trends, as it nears the June low at 95.72 ahead of the longer-term March low at 94.65.

All eyes on EU Leaders

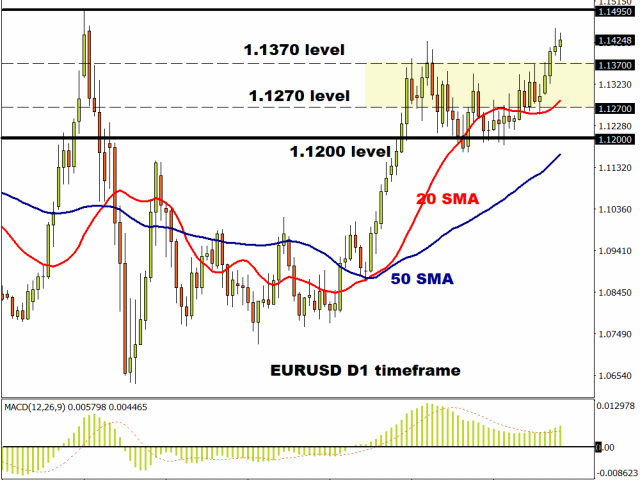

President Lagarde happily moved the focus of the eurozone to fiscal policy and the weekend’s EU meeting when she said a ‘large number of leaders is well aware of the importance of not wasting time’. The ECB are hoping for agreement as are the Euro bulls as buyers push the single currency towards yesterday’s highs at 1.1452.

Momentum indicators are not overbought in what is the fifth consecutive days of gains. Targets above include the March high at 1.1495, but so much depends on the discussions over the Recovery Fund. Support comes in around 1.1375/80.

BoC meeting enhances forward guidance

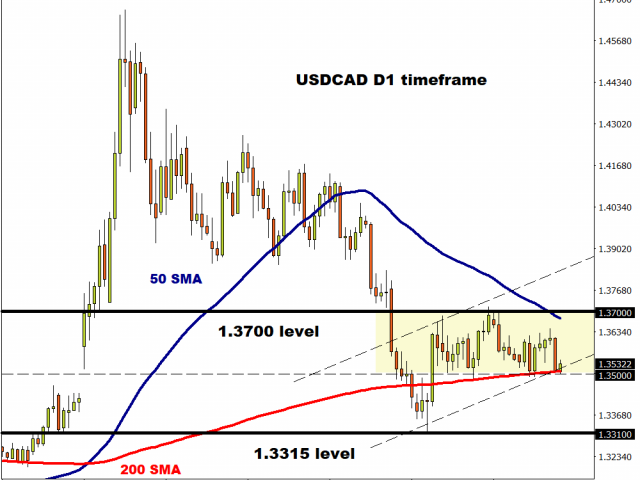

The Bank of Canada yesterday emphasised that policy will remain ultra-accommodative for a number of years and other tools remain in the tool box – except negative rates. This means longer-dated yields will stay depressed, but it keeps markets from pricing in more rate cuts, unlike in the US.

USD/CAD failed again at the March trendline mentioned yesterday and is now sitting squarely on the 200-day Moving Average. A break lower sees little support until the June low at 1.3315.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.