The initial mild reaction to the EU summit agreement has been taken over by the bulls as EUR/USD has surged to 21-month highs. Despite plenty of good news being priced in, there appears to be limited downside as a potential re-rating of euro bonds and equities takes place.

Further dollar weakness is also at hand and not helped by US lawmakers making little progress on another stimulus package to replace existing Federal support that is due to expire shortly. An agreement remains likely but may take some time and that is affecting the broader risk tone today with stocks flat on the day so far.

Geopolitical tensions are adding to this cautious mood with the news that the US has ordered China to close one of its consulates in order ‘to protect American intellectual property’. This has helped Gold to push higher again as it nears $1900.

Metal strength aiding the Aussie

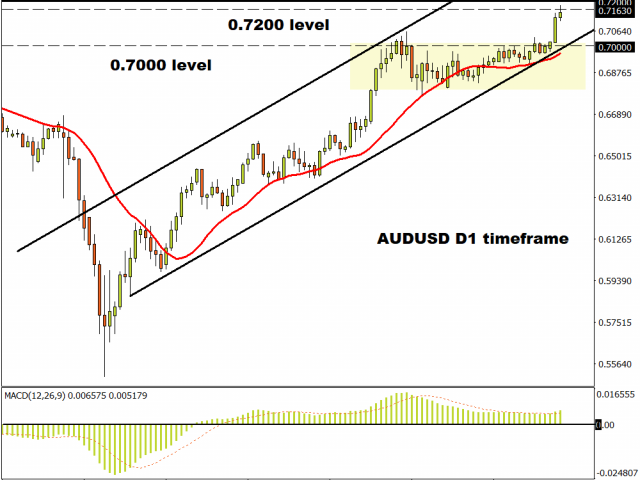

It is noticeable that the China tensions are not affecting the AUD which is positive again today. Having consolidated in 260 pip range for the last 6 weeks, yesterday saw the Aussie skyrocket 1.89% or 130 basis points. The weekly resistance level at 0.7163 has been touched and if we see a strong close above here, prices can move up towards 0.72.

AUD has a positive correlation with risk so any promised retaliation from China may hurt and talks of an extension of lockdowns in Melbourne could also impact confidence.

Weaker Oil not hurting CAD

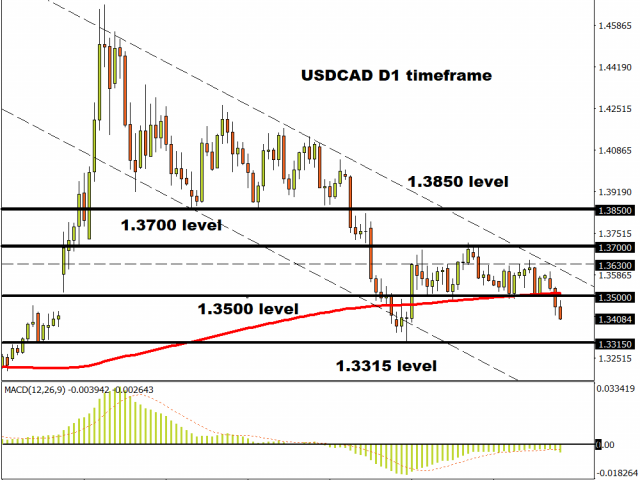

Yesterday’s retail sales disappointed expectations but the ‘flash’ estimate for June implies a near-full recovery from the pandemic trough. Today’s move lower in oil is not impacting the loonie as USD/CAD sinks below its 200-day Moving Average.

Big dollar weakness now sees firm resistance around 1.35 as oscillators reflect a strengthening in the bearish trend. A retest of major support around the June low at 1.3315 looks to be on the cards.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.