Asian stocks and US equity futures are mixed, as global investors have been dealt with a major twist just six weeks before the US Presidential elections.

Supreme Court Justice Ruth Bader Ginsburg passed away on Friday, which means her seat has now been vacated in the highest federal court in the land. US President Donald Trump and his fellow Republicans are now rushing to fill that seat, as this appointment would be monumental in shaping the Supreme Court’s ideological framework for many years to come, potentially even beyond the tenure of the next President of the United States. And a more conservative-leaning jurist would be most appealing for President Trump’s voter base, something which Democratic nominee Joe Biden would want to prevent.

In other words, the November 3rd elections is set to become not just be about who occupies the White House, but also the Supreme Court.

Since the pandemic broke out, market participants have been hoping for more stimulus packages from policymakers, and Washington DC has been locked in battle between Republicans and Democrats over the next round of US fiscal support.

However, this fight for the Supreme Court vacancy could dominate the political agenda in the lead up to the elections, perhaps at the expense of the next round of fiscal stimulus. This might deflate some of the optimism that’s still baked into US equities about more incoming financial support for the world’s largest economy to boost the performance of stock markets. Instead, it adds another major element of uncertainty over the next 44 days.

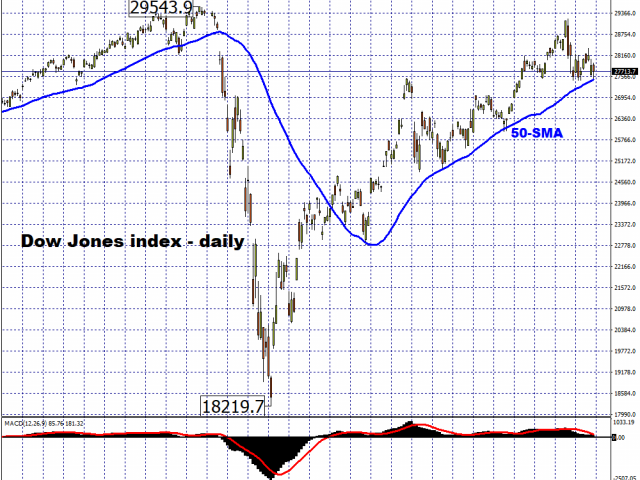

With the Dow Jones index now testing its 50-day moving average, a break below this support level could make the benchmark index susceptible to further declines until it can find a steadier footing. At the time of writing, the FXTM Trader’s Sentiment on the Wall Street 30 (Mini) remains short.

This turn of events means that fundamentally-driven investors who have been paying attention solely on the US economy and policymakers’ response to the pandemic may have to focus a lot more on the political narrative over the coming weeks. Although voting for the next President of the United States is already underway in several states, whoever can best galvanize their supporters over the Supreme Court battle could have the upper hand in the Presidential race. And as we know, the eventual winner of the November 3rd polls, and his policies, would certainly have a major bearing over the performance of global markets over the ensuing four years.

Already, since the passing of Justice Ginsburg, Democratic candidates received over US$103 million in donations on Sunday alone. It now remains to be seen how investors’ funds will flow when US stock markets open for trading this week.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.